The US stock market witnessed a significant moment this week as the Dow Jones Industrial Average closed above 48,000 for the first time in history, marking a new milestone for Wall Street. This surge came amid rising optimism that the ongoing US government shutdown might finally be coming to an end. But while the Dow celebrated a historic high, the story was very different for the tech-heavy Nasdaq, which slipped despite the broader market rally.

This dual movement,record highs on one side, stagnation and decline on the other—highlights a growing divide in market behavior. It raises deeper questions about the state of the tech sector, the influence of political uncertainty, and the evolving relationship between economic fundamentals and investor sentiment.

In today’s 1500-word blog, we break down:

- Why the Dow is soaring

- Why tech is lagging

- How political and macroeconomic forces are shaping markets

- What this means for investors

- The future outlook for AI-exposed tech companies

- Why infrastructure, regulation, and valuation resets matter more than ever

Let’s dive in.

1. A Record Day for the Dow: What Happened?

The Dow Jones Industrial Average, which tracks 30 major blue-chip companies, crossed the 48,000 mark,its highest level ever. Several factors contributed to this surge:

Renewed optimism regarding the end of the US government shutdown

Markets dislike political uncertainty. Hints that Congress may resolve the shutdown created immediate relief.

Strong performance from industrials and financials

Banks, manufacturing, retail, and traditional economy sectors outperformed, driving the index upward.

Robust consumer spending data

Recent reports suggest American consumers continue spending at strong levels despite inflation pressures.

Lower volatility and improved investor confidence

Investors shifted money from safe-haven assets into equities, lifting the Dow.

The overall picture for the Dow reflects a market that,at least temporarily,believes stability is returning.

But that confidence wasn’t shared across all sectors.

2. The Nasdaq Slips: Why Tech Didn’t Ride the Rally

While the Dow reached new heights, the Nasdaq Composite fell, signaling persistent concerns about the technology sector. Why? Because tech companies face their own set of challenges, different from those affecting traditional industries.

Here are the main reasons tech is struggling:

2.1 Valuation Pressure From the AI Boom

The past few years created a massive wave of AI-driven enthusiasm. Stocks tied to AI:

- soared rapidly

- reached stretched valuations

- priced in years of future growth

But now investors are questioning:

- Are these valuations sustainable?

- Are AI revenues scaling fast enough?

- Is the hype ahead of reality?

Tech companies with heavy AI exposure were particularly hit.

2.2 Higher Interest Rates Impact Growth Stocks

Tech companies rely on future earnings. When interest rates rise, the value of those future earnings declines.

Traditional industries (like those in the Dow) tend to survive rate hikes better. Tech does not.

2.3 Growing Competition in AI Infrastructure

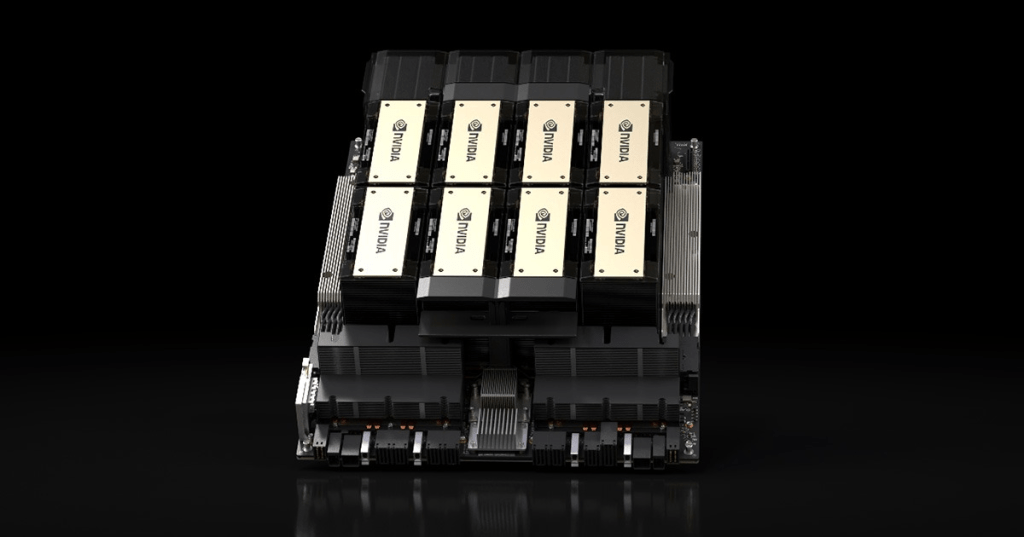

AI requires enormous compute power. The race for GPUs, data centers, and custom silicon is fierce,and expensive.

Companies failing to scale infrastructure fast enough may fall behind competitors like:

- NVIDIA

- Microsoft

- Google

- Amazon

- Anthropic (in AI infrastructure investment)

This creates uncertainty for mid-tier and smaller tech firms.

2.4 Regulatory Scrutiny Is Increasing

Governments are now asking tough questions:

- How safe are AI models?

- Should AI companies be regulated?

- Are data practices secure?

- Are tech monopolies harming competition?

These pressures reduce investor appetite for long-term speculative plays.

2.5 Investors Prefer “Safe” Sectors During Political Instability

With a government shutdown looming, investors flocked to defensive sectors:

- Utilities

- Health

- Financials

- Industrials

Tech, being risk-heavy, didn’t benefit the same way.

3. Why This Matters: The Bigger Picture Behind the Market Split

The divergence between the Dow and Nasdaq isn’t random. It reflects deeper market realities.

3.1 The Economy Is Normalizing, Tech Is Recalibrating

For years, tech drove market performance. Now, traditional industries are showing resilience while tech digests:

- valuation resets

- infrastructure bottlenecks

- monetization challenges

- rising costs

- competition

- regulation

This doesn’t mean tech is crashing,it means it’s maturing.

3.2 AI Hype Is Cooling Into Realistic Expectations

Investors once believed AI would instantly transform every sector.

Now, they are asking more practical questions:

- What are real AI revenues?

- How fast can AI scale?

- Are companies spending more than they earn?

This shift from hype to fundamentals is healthy.

Companies with real products and sustainable growth will survive. Those riding hype only may struggle.

3.3 Macro Forces Drive Tech More Than Product Launches

In the early 2010s, product announcements moved markets.

Today, tech valuations depend more on:

- interest rates

- government policies

- regulatory frameworks

- infrastructure investment

- data center availability

- GPU supply chains

Tech is no longer a niche,it’s a geopolitical and economic centerpiece.

4. Why Investors Should Pay Attention to Market Context, Not Buzz

For the modern investor, this split market environment offers valuable lessons.

4.1 Tech Is Now a Long-Term Play, Not a Short-Term Trade

High-growth tech cannot be evaluated on:

- quarterly earnings alone

- viral product launches

- AI headlines

Instead, long-term factors matter:

- infrastructure scaling

- cost efficiency

- partnerships

- regulatory alignment

- compute access

- data capabilities

Investors must look deeper

4.2 Blue-Chip Stability Is Returning

Industrials, energy, consumer goods, and financials are showing strength.

These are:

- more stable

- less speculative

- less dependent on cheap money

In uncertain macro environments, these sectors outperform.

4.3 AI Infrastructure Will Shape the Next Decade of Winners

Tech winners of tomorrow will be companies that can:

scale AI infrastructure

secure GPUs and data pipelines

build efficient training clusters

develop sustainable AI business models

Companies unable to scale will fade, even if their products are impressive.

4.4 Political and Government Developments Now Move Markets

The entire market rally,Dow’s record,was driven by optimism surrounding:

- a potential end to the government shutdown

- possible fiscal stability

- reduced political risk

This proves that political signals are now as important as earnings reports.

5. What’s Next for the Dow and Tech Sector?

Let’s explore possible scenarios based on current patterns.

Scenario 1: The Dow Continues to Rise (Most Likely)

If the shutdown ends and economic data holds:

- investor confidence grows

- consumer spending stays strong

- traditional sectors remain stable

Dow momentum will likely continue.

Scenario 2: Tech Sees a Gradual Rebound

Once investors digest:

- AI valuation resets

- regulatory norms

- realistic revenue expectations

Tech may recover steadily,especially companies with strong fundamentals.

Scenario 3: AI Infrastructure Becomes the Deciding Factor

Tech companies investing in infrastructure (data centers, GPUs, chips) will outpace content-driven or feature-driven tech.

Expect:

- rising CAPEX

- GPU wars

- cloud expansion

- custom silicon innovation

This is where future winners are being built.

Scenario 4: Macro Forces Continue Driving Market Behavior

The market will remain extremely sensitive to:

- government shutdown progress

- interest rate decisions

- inflation data

- employment reports

- regulatory announcements

Tech will remain volatile,Dow will remain steady.

Conclusion: A Tale of Two Markets and a Lesson for the Future

The Dow hitting 48,000 is a monumental achievement, reflecting investor optimism and economic resilience. Meanwhile, the Nasdaq’s slip reveals pressures facing the tech sector,valuation uncertainty, infrastructure challenges, rising costs, and regulatory scrutiny.

The key takeaway?

We are entering a new phase of market dynamics where tech cannot rely on hype alone. It must prove long-term value.

For investors:

- Watch macro factors

- Monitor political developments

- Study AI infrastructure investments

- Look beyond headlines

- Focus on fundamentals

The future of tech remains incredibly bright,but also more competitive, more expensive, and more complex.

The Dow’s rise and the Nasdaq’s decline together paint a clear picture:

The market is shifting. And the smart investors are shifting with it.

Leave a comment