AI’s Explosive Growth Comes With a $7 Trillion Warning

The global AI boom is accelerating at a historic pace, but so are the risks.

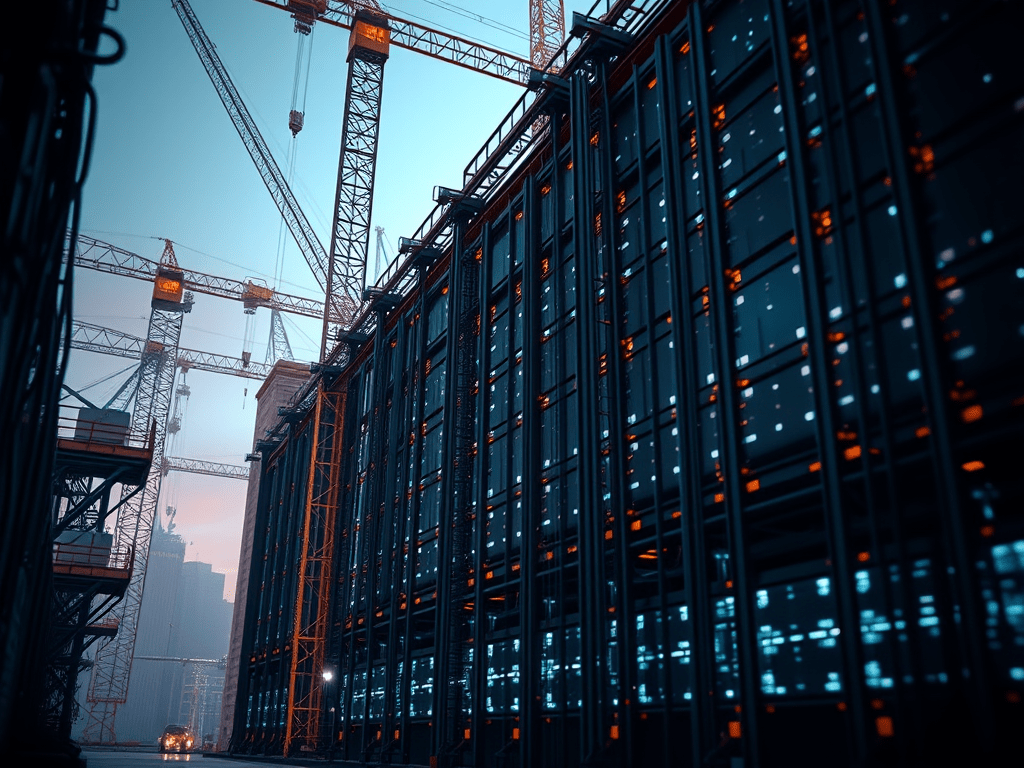

According to Reuters, analysts estimate that nearly $7 trillion in investment will be required to build enough AI data centers by 2030. This massive capital demand is fueling a wave of aggressive spending, high-premium acquisitions, and sky-high market valuations.

But as investment surges, so does caution.

If returns don’t materialize fast enough, or if AI models fail to deliver promised performance, markets could face a painful correction.

Summary :

- AI adoption is accelerating across every major industry.

- Analysts project $7 trillion in global AI data center investment needs by 2030.

- Companies are spending heavily on compute, GPUs, and infrastructure, often ahead of proven ROI.

- M&A deals in the AI sector are hitting record valuations, raising long-term risk.

- Startups face rising barriers due to skyrocketing compute and talent costs.

The Deeper Analysis: AI’s New Capital Reality

The AI space is no longer defined only by algorithms or innovation, it is increasingly a battle of capital scale.

Training cutting-edge models requires:

- thousands of GPUs or custom silicon,

- energy-hungry supercomputing clusters,

- vast cooling infrastructure,

- and global networks of new data centers.

These are no longer “startup-friendly” costs.

As a result, the AI industry is experiencing:

1. Skyrocketing CapEx

Tech giants are pouring tens of billions into AI infrastructure annually.

2. Overheated M&A markets

Companies are paying premiums to acquire AI startups and talent, hoping to secure an edge before the field matures.

3. Rising operational costs

The ongoing demand for compute power, energy, and rare engineering talent is pushing budgets to breaking points.

Impact & Implications for the Industry

A. The AI Bubble Question

If investment greatly outpaces adoption, particularly enterprise usage, analysts warn that a correction could hit overvalued AI stocks and late-stage startups.

B. Barriers to Entry Are Higher Than Ever

Startups now face a brutal reality:

- Compute is expensive

- GPUs are scarce

- Talent is pricey

- Infrastructure requires deep pockets

This pushes founders to focus on efficiency, clear differentiation, and strong business models not just hype.

C. Investors Are Becoming More Selective

The easy-money era for AI may be ending.

Capital is shifting toward companies with:

- real revenue,

- defensible IP,

- and clear use cases that reduce cost or boost productivity.

Global Relevance

This isn’t just a Silicon Valley issue.

Countries worldwide from India to Europe to Southeast Asia are facing similar challenges:

- How to fund national AI infrastructure

- How to secure GPUs and chips

- How to scale AI sustainably

- How to attract specialized AI talent

As AI becomes a geopolitical priority, capital allocation is becoming a competitive differentiator on the global stage.

Conclusion: The AI Gold Rush Requires Discipline

AI is the fastest-growing technology wave in decades, but also one of the most capital-intensive.

The next few years will test whether companies can balance ambition with sustainability.

Those who can innovate efficiently, avoid overspending, and show real-world impact will lead the next phase of AI growth.

Those who rely on hype may face a harsh correction.

The AI boom is real, but so are the risks.

Leave a comment