Across the United States, a growing frustration is taking hold, one that cuts across age, income, geography, and political affiliation. The issue isn’t simply inflation or wages or interest rates. It’s something deeper, more personal, and more persistent:

The cost of living has become unmanageable for millions of Americans.

According to recent reporting from Business Insider, affordability pressures remain one of the biggest political-economic headaches facing the country. Even though inflation has slowed from its peak, the prices of essential goods are still far higher than they were just a few years ago. Housing, healthcare, groceries, utilities, childcare, these aren’t discretionary purchases. They are the foundations of everyday life, and for many families, they now consume most of the monthly budget.

The result?

A population that feels financially cornered, and a political landscape under immense strain.

The Affordability Problem: What’s Driving the Crisis?

Even as economic indicators show mixed improvement, Americans are still wrestling with the day-to-day reality of higher prices. Here are the key pressure points:

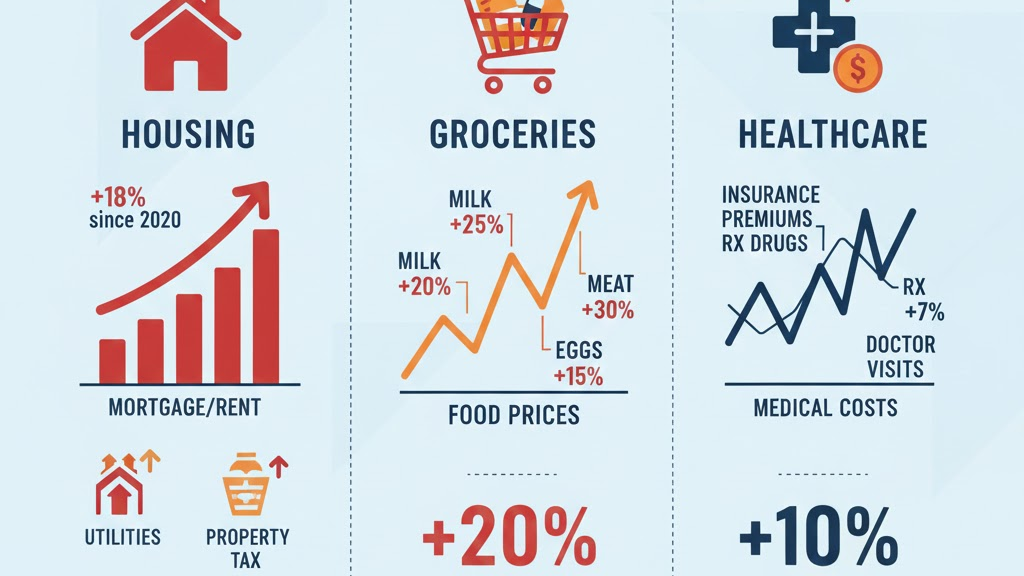

1. Housing Costs Are at Record Highs

Whether renting or buying, Americans face:

- mortgage rates above historical norms

- limited housing supply

- bidding wars in many cities

- soaring rental rates in urban and suburban areas

For many young families and first-time buyers, homeownership feels completely out of reach.

2. Healthcare Remains Excessively Expensive

The U.S. healthcare system is already one of the world’s costliest.

In 2025, Americans continue to struggle with:

- rising insurance premiums

- expensive prescription drugs

- high out-of-pocket medical costs

For many households, one medical emergency can still lead to debt.

3. Grocery Prices Haven’t Returned to Pre-Inflation Levels

Even though inflation has slowed, pricing is still elevated:

- meat

- dairy

- fruits and vegetables

- packaged foods

A typical grocery run now costs far more than it did in 2019–2021, and wages have not kept up.

4. Everyday Bills Are More Expensive

Utilities such as electricity, gas, water, and internet continue to rise.

Transportation costs have also gone up due to:

- higher car insurance premiums

- pricier auto repairs

- lingering supply-chain effects

- elevated fuel costs

These aren’t luxuries. They are essential expenses, and they are eating away at household budgets.

Why Americans Feel Worse Off, Even When the Economy Is Growing

This is where the problem becomes more complicated:

Economic data says one thing, but lived experiences say another.

Unemployment is low.

Corporate earnings are improving.

The service sector is expanding.

Business optimism is rising.

Yet, consumers feel financially exhausted.

Here’s why:

- Inflation slowing doesn’t mean prices falling.

- Wages haven’t kept pace with cumulative price increases.

- Interest rates remain high, making borrowing extremely expensive.

- Debt levels, especially credit cards, have surged to historic highs.

This disconnect between macroeconomic indicators and microeconomic reality is creating a unique moment of social tension.

The Political Fallout: Why Affordability Has Become a Flashpoint

As Business Insider highlights, affordability is no longer just an economic problem.

It’s a political powder keg.

1. Policy Pressure Is Increasing

Lawmakers are floating several proposals:

- rebates or tax credits

- longer mortgage terms (e.g., 40-year mortgages)

- subsidized housing programs

- caps on healthcare costs

- grocery price reforms or oversight

But economists warn that many of these ideas:

- may offer only temporary relief

- could increase long-term debt

- risk distorting markets

- fail to address root causes

Voters, meanwhile, are demanding bold solutions, and losing patience.

2. Affordability Will Shape the Next Election Cycle

When people are financially stressed:

- voting patterns shift

- incumbents face pressure

- economic messaging becomes crucial

- trust in institutions weakens

Food, housing, and healthcare costs influence public opinion more than any abstract economic statistic.

3. Both Parties Are Struggling to Respond

Democrats and Republicans both claim they can “fix” affordability, yet neither side has produced a universally accepted solution.

The challenge:

This crisis wasn’t caused by one administration, one policy, or one event.

It is the result of years of structural issues.

Why Affordability Problems Can Slow the Entire Economy

Weak consumer sentiment and financial stress can create a domino effect:

1. Reduced Spending

Families cut back on:

- travel

- dining out

- entertainment

- retail purchases

This slows economic growth.

2. Increased Debt Burdens

When people rely on credit cards to survive, defaults and delinquencies rise.

3. Lower Homeownership

Housing markets cool, reducing household wealth creation.

4. Business Slowdowns

When consumer demand drops, companies freeze hiring or reduce investment.

5. Economic Confidence Declines

A pessimistic consumer base can drag the economy into slower growth, even if businesses are doing well.

The Structural Roots of the Affordability Crisis

To truly understand the problem, we must look long-term.

The U.S. faces deep structural challenges:

- chronic housing shortages

- healthcare system inefficiencies

- supply-chain fragility

- corporate consolidation in key industries

- slow wage growth relative to profits

- high debt loads

Without structural reform, short-term fixes won’t solve the underlying issues.

Conclusion: Affordability Is the Defining Economic Issue of Our Time

The affordability crisis is more than an economic phenomenon — it’s a deeply emotional, political, and social issue reshaping daily life in America.

It influences:

- how people vote

- where people live

- how they spend

- how they feel about the future

Until prices stabilize and wages meaningfully catch up, affordability will remain at the center of national debate.

The message is unmistakable:

An economy cannot be considered strong if its people feel financially strained.

Leave a comment