The global semiconductor industry has just received an important signal of recovery and renewed momentum. Microchip Technology, one of the world’s leading suppliers of microcontrollers, analog semiconductors, and embedded solutions, has officially raised its profit and revenue forecasts for the third quarter of 2025, according to Reuters.

This development stands out because Microchip is widely considered a bellwether for the broader electronics market. Its components are found in nearly every segment of the technology ecosystem, from automotive and aerospace to consumer electronics, industrial machinery, medical devices, and IoT infrastructure. When Microchip reports stronger-than-expected orders and improved financial performance, it often indicates that the entire semiconductor value chain is entering a healthier phase.

The updated forecast suggests that after periods of supply-chain turbulence, fluctuating demand, and cyclical downturns, the electronics and semiconductor markets are stabilizing and edging toward growth once again.

A Sign of Strength: What Microchip’s Upgraded Forecast Tells Us

Microchip Technology’s improved Q3 outlook is driven by a combination of strong customer orders, steady market demand, and broader recovery across multiple end-use sectors. The company’s management noted that both revenue and profitability are set to exceed earlier estimates, a reflection of resilient market conditions in 2025.

Several key demand drivers are at play:

- Automotive electronics remain one of the strongest segments

- Industrial automation and IoT deployments continue expanding globally

- Power management and energy-efficient systems are seeing renewed demand

- Embedded computing is accelerating across multiple industries

These categories rely heavily on Microchip’s core product lines, including microcontrollers (MCUs), analog ICs, FPGAs, and connectivity solutions. This is why Microchip’s performance is often viewed as a snapshot of the broader electronics ecosystem.

Understanding the Market Forces Behind the Upswing

To appreciate the significance of Microchip’s raised forecast, it’s important to understand the underlying shifts taking place in the semiconductor market.

1. Automotive Electronics Continue to Surge

The automotive sector has been one of Microchip’s most stable and fastest-growing markets. Modern vehicles require hundreds of chips for critical systems such as:

- Advanced driver assistance systems (ADAS)

- Battery management and EV powertrains

- Infotainment units

- Safety and sensor modules

- Connectivity and telematics

With global EV production rising and new safety regulations pushing automakers to adopt smart technologies, demand for microcontrollers and analog chips remains strong. Microchip is a preferred supplier in this sector due to its long product lifecycles, automotive-grade reliability, and extensive engineering support.

2. Industrial Automation & Factory Modernization

Industrial electronics continue to expand as companies adopt robotics, automation, and AI-driven manufacturing. Microchip’s components power:

- Smart industrial controllers

- Robotics platforms

- Energy management systems

- Industrial IoT (IIoT) sensors

- Power electronics

As global manufacturing shifts toward digital transformation, industrial customers are increasing their semiconductor procurement, contributing to Microchip’s improved outlook.

3. IoT and Embedded Systems Are Scaling Up

The rise of smart homes, smart cities, healthcare monitoring systems, and connected infrastructure is fueling demand for low-power microcontrollers and connectivity chips.

- IoT devices rely on Microchip’s ultra-low-power MCUs

- Smart sensors require reliable analog components

- Edge AI systems depend on flexible, integrated chips

These trends are expected to accelerate through 2025 and beyond.

4. A More Stable and Predictable Supply Chain

One of the biggest challenges from 2021–2023 was supply-chain instability. Lead times for critical chips stretched to 30–50 weeks, causing widespread production halts.

But by late 2024 and into 2025:

- Lead times normalized

- Inventory levels improved

- Logistics networks stabilized

- Manufacturing output increased

As a result, customers are once again placing consistent, bulk orders a crucial factor behind Microchip’s improved forecast.

A Broader Look: What Microchip’s Momentum Means for the Semiconductor Industry

Microchip’s raised outlook serves as a leading indicator for the entire semiconductor market, especially the segments that don’t always dominate headlines but power the world’s most essential technologies.

While AI chips and high-end GPUs currently generate much of the attention, the foundation of the electronics ecosystem still depends heavily on:

- Microcontrollers

- Analog and mixed-signal ICs

- Power management chips

- Connectivity modules

- Embedded processing solutions

These are precisely Microchip’s strengths. The company’s improved performance signals:

1. A Rebound in “Everyday Electronics” Production

From home appliances to industrial machinery, production is rising again. This is a positive sign for global economic stability.

2. Increased Investment in Embedded Engineering

Companies are expanding R&D efforts for next-generation devices, leading to greater semiconductor consumption.

3. Confidence Returning to the Electronics Supply Chain

Manufacturers are no longer hesitating to place orders, a notable shift from the cautious approach seen during the slowdown.

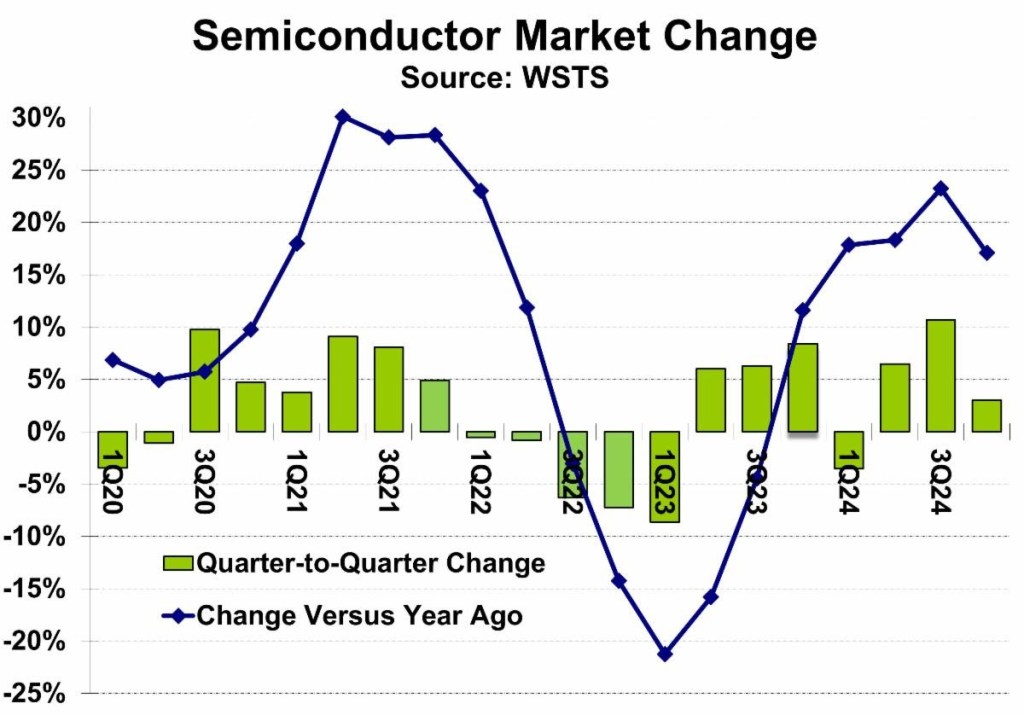

4. Renewed Stability in Semiconductor Cycles

The chip industry has always been cyclical, but Microchip’s outlook implies the start of a new growth cycle heading into 2025.

Investor and Market Implications

Microchip’s stronger forecast is good news not just for the company but also for investors, suppliers, and partners across the semiconductor industry.

1. Increased Investor Confidence

Companies that raise forecasts typically show strong operations, efficient cost management, and resilient demand. Microchip’s performance may influence investor sentiment across mid-range semiconductor players.

2. Rising Valuations for Analog & MCU Suppliers

If Microchip is seeing strong demand, similar vendors in the analog and embedded space may also experience growth.

3. Healthy Signs for Electronics OEMs

Improved chip availability and predictable pricing pave the way for smoother production cycles across consumer, automotive, and industrial sectors.

4. Positive Impact on Semiconductor Supply Chains

Suppliers, distributors, and manufacturing partners benefit when demand stabilizes and production ramps up.

Looking Forward: What This Means for 2025 and Beyond

As Microchip enters Q3 2025 with renewed confidence, several long-term trends are becoming clearer:

- Electric vehicles and autonomous systems will intensify demand for embedded chips

- Industrial automation will keep growing as factories modernize

- IoT and edge intelligence will expand into new sectors

- Semiconductor demand will shift from cyclical recovery to sustained growth

Microchip is well-positioned to capitalize on these changes thanks to its broad portfolio, long-term supply programs, engineering support ecosystem, and reputation for reliability.

Conclusion: A Strong Signal of Growth in the Chip Industry

Microchip Technology’s decision to raise its Q3 2025 profit and revenue forecast marks a key turning point for the semiconductor industry. After several years of volatility, the market is showing signs of steady, healthy demand across automotive, industrial, IoT, and embedded sectors.

This news not only reflects Microchip’s resilience but also underscores a bigger truth:

the world’s need for reliable, efficient, embedded semiconductor technology is stronger than ever.

As we move deeper into 2025, Microchip’s momentum may very well be a preview of a broader industry resurgence, one that shapes the next generation of intelligent, connected technologies.

Leave a comment