Even with warnings about overstretched valuations, rising corporate debt, and slowing earnings growth, one trend is becoming clearer with each passing quarter: money is still pouring into the tech sector at a record pace.

Analysts now estimate that 2025 is on track to register the highest investor inflows into technology stocks, ETFs, and AI-focused funds in history. This contradicts the narrative of caution dominating recent headlines and instead reveals a deeper reality:

Investors overwhelmingly believe in a long-term AI and data-driven economic boom.

Whether this optimism is justified or overly speculative remains debated. But one thing is undeniable: the technology sector continues to attract more capital than any other part of the global market.

Why Investors Are Still Pouring Money Into Tech in 2025

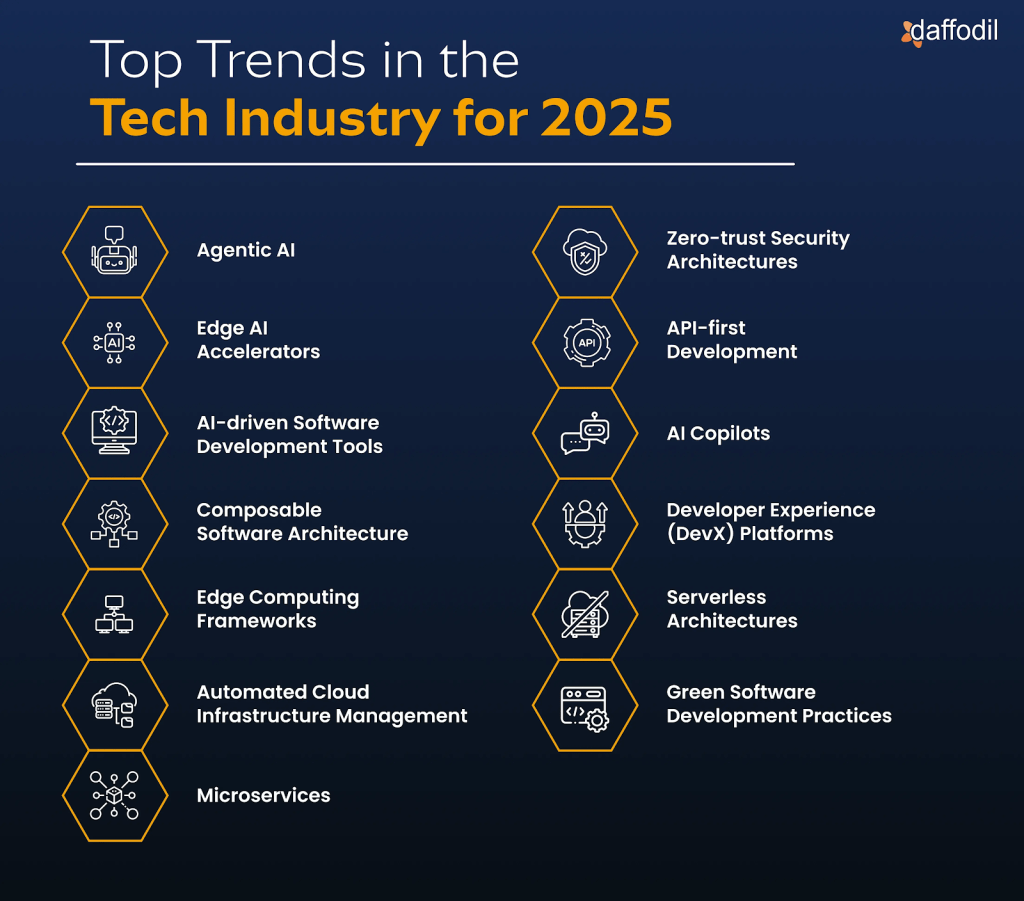

Despite short-term risks, the long-term outlook for AI, cloud computing, semiconductors, robotics, and digital infrastructure remains incredibly strong. Several factors explain why investors refuse to turn away.

1. AI Is Seen as the Next Multi-Trillion-Dollar Economic Revolution

Generative AI is still in its early stages, yet its potential impact touches nearly every industry:

- Healthcare diagnostics

- Enterprise automation

- Transportation and autonomous systems

- Cybersecurity

- Finance and algorithmic decision-making

- Creative industries and digital content

Investors see AI not as a trend, but as a platform shift, similar to the rise of the internet or smartphones.

In this context, pouring money into tech feels less like speculation and more like securing a front-row seat to the future economy.

2. Semiconductors and Data Centers Are Now “Critical Infrastructure”

The massive investment surge into:

- AI chips

- High-density data centers

- GPU clusters

- Energy-efficient servers

- Cloud infrastructure

has turned companies like Nvidia, AMD, Broadcom, Amazon, and Microsoft into indispensable pillars of the modern digital world.

Investors believe these companies will power global productivity for decades, making them highly attractive long-term plays.

3. Strong Balance Sheets Still Make Big Tech Look Safe

Even with rising debt levels, Big Tech firms still hold enormous:

- Cash reserves

- Free cash flow generation

- Market share dominance

- R&D capacity

- Global customer ecosystems

Compared to other sectors dealing with weak growth and high volatility, tech continues to appear both profitable and resilient.

4. Retail and Institutional Investors Are Increasing Exposure to AI

From pension funds to hedge funds to everyday traders, everyone wants a piece of the AI growth cycle.

Key areas seeing inflows:

- AI-themed ETFs

- Semiconductor ETFs

- Cloud computing funds

- Robotics & automation funds

- Megacap tech stock baskets

The momentum becomes self-reinforcing: the more inflows, the more prices rise, attracting even more inflows.

5. Limited Growth Opportunities Outside Tech

In 2025, many traditional sectors face:

- Slower consumer demand

- Higher interest rates

- Margin compression

- Weak global trade

Meanwhile, tech remains one of the few sectors with clear multi-year growth visibility.

For investors seeking returns, the choice appears obvious: go where innovation and profitability continue to grow.

Does This Mean Tech Is in a Bubble?

The answer is nuanced.

Signs That Point to a Bubble:

- Valuations are extremely high

- Earnings growth is slowing for some companies

- AI revenues lag behind investment spending

- Massive borrowing is creating new risks

- Market concentration is at historic levels

Yet…

Reasons It Might Not Be a Bubble:

- AI is a genuine technological revolution

- Demand for computing power is surging exponentially

- Corporations worldwide are integrating AI tools

- Governments are investing heavily in digital infrastructure

- Tech companies remain enormously profitable

In other words: tech might be overvalued in the short term, but undervalued in the long-term transformation it will create.

Investor Psychology: Why Optimism Is Winning

The market is behaving as if:

- AI is inevitable

- Cloud computing will continue expanding

- Data is the new global currency

- Tech will lead the next economic cycle

- Innovation will outpace risks

This narrative whether overly optimistic or grounded in reality is powerful. It is pulling massive capital into the sector, reshaping global financial flows.

2025 Could Mark a Historic Turning Point

If current inflows continue, 2025 may be remembered as the year:

- AI moved from hype to mainstream adoption

- Tech became the center of global investment strategy

- Semiconductors became the world’s most critical commodity

- Data and compute capacity became new forms of economic power

Even with risks on the horizon, investors are overwhelmingly betting that technology will define the next decade of global growth.

Tech Remains the Most Powerful Magnet for Global Capital

Despite warnings of risk, the data is clear:

Money is still flowing into tech faster than ever before.

Record inflows reflect a market that believes:

- AI will transform industries

- Data infrastructure will rival traditional energy infrastructure

- Tech companies will lead global innovation

- Long-term returns outweigh short-term volatility

In an uncertain world, technology has become the ultimate source of growth, optimism, and opportunity.

And 2025 is shaping up to be one of the most transformative years yet.

Leave a comment