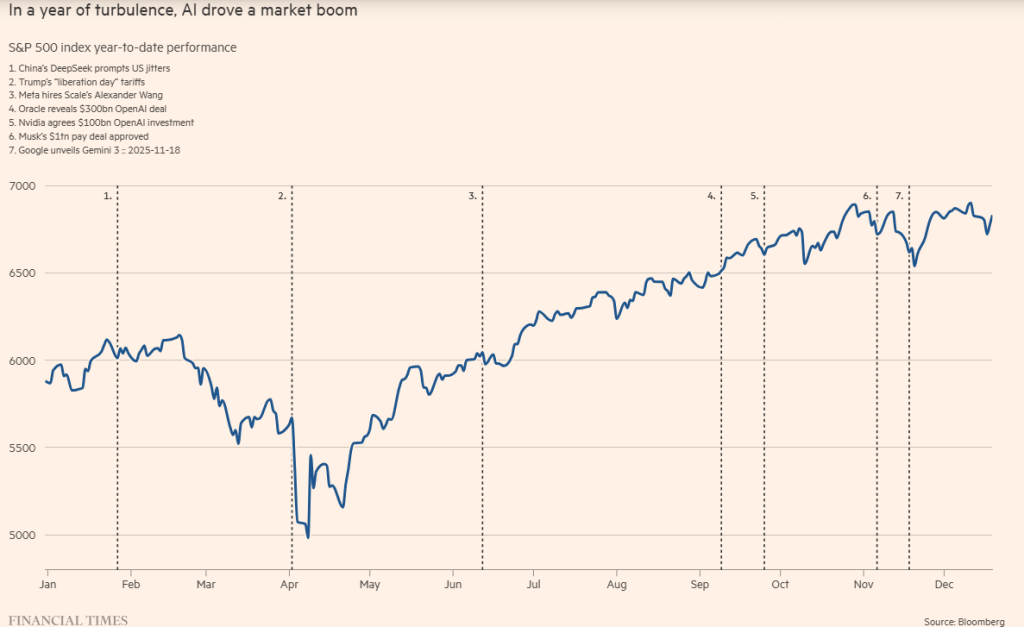

The artificial intelligence revolution isn’t just transforming industries, it’s radically reshaping personal fortunes at the very top. In 2025, AI-driven market gains have reportedly added hundreds of billions of dollars to the net worth of U.S. tech billionaires, cementing AI as the most powerful wealth engine of the decade.

Leading the surge are familiar names like Elon Musk and Jensen Huang, whose companies sit at the center of the global AI infrastructure boom.

Why AI Is Creating So Much Wealth

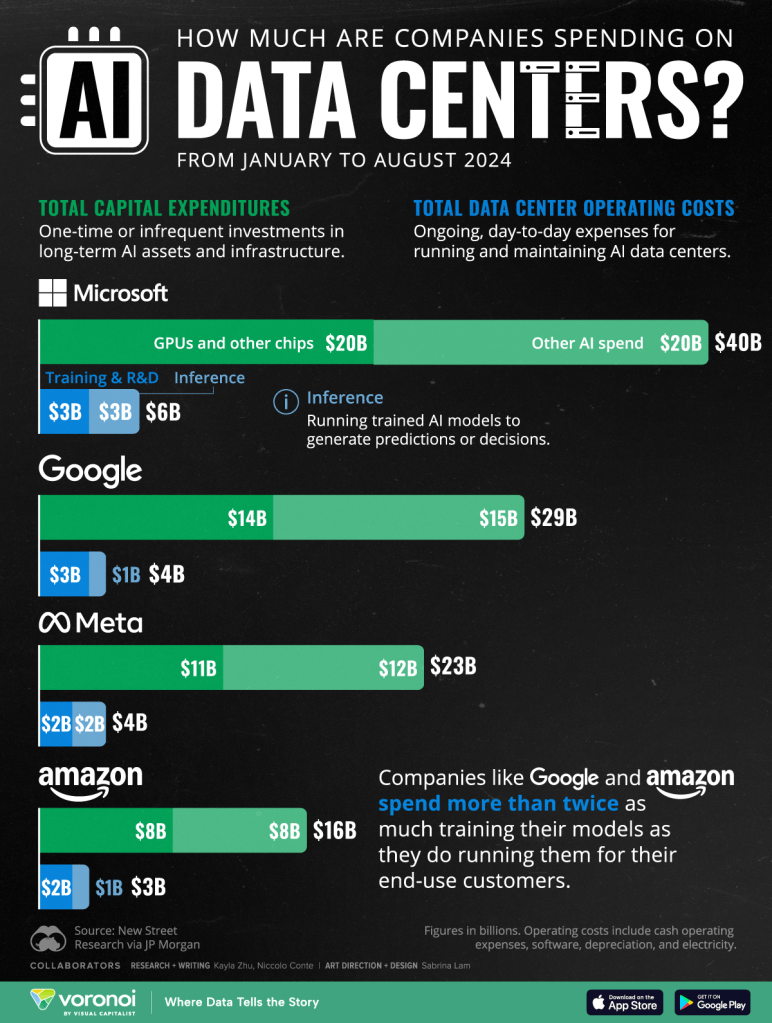

Unlike previous tech cycles, AI touches nearly every layer of the economy software, hardware, cloud services, energy, defense, and consumer products. Investors are pouring capital into companies that build:

- AI chips and accelerators

- Cloud computing platforms

- Generative AI models and tools

- Data centers and AI infrastructure

As stock prices surge, founders and top executives with large equity stakes are seeing unprecedented gains on paper.

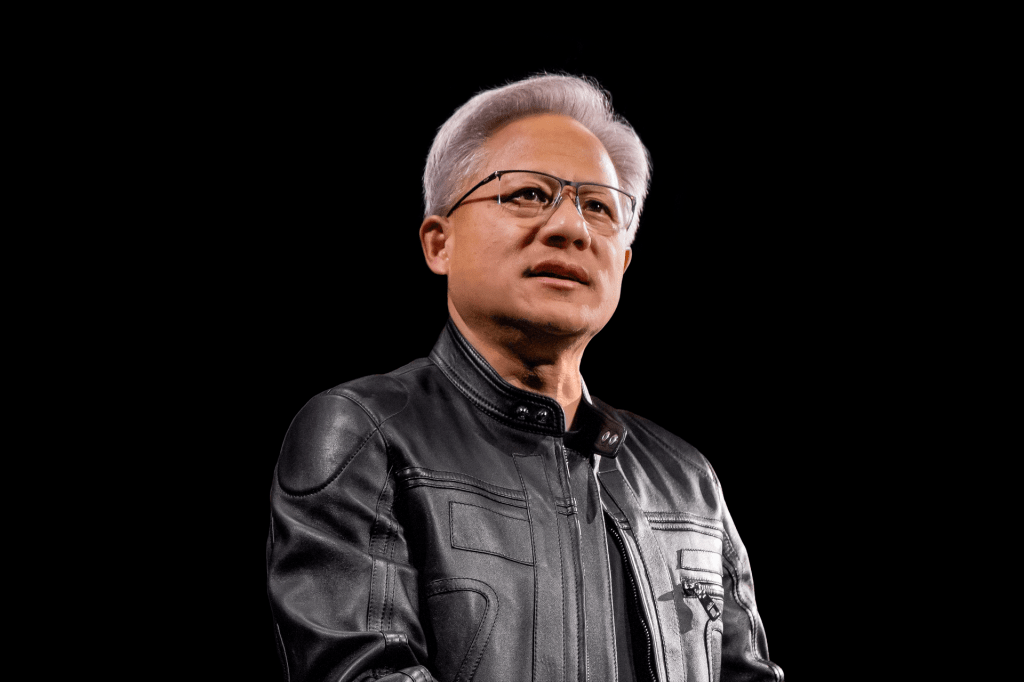

Nvidia: The Epicenter of the AI Gold Rush

Few companies illustrate this better than Nvidia. As demand for AI chips exploded, Nvidia’s valuation soared, dramatically boosting Jensen Huang’s personal wealth. Nvidia’s GPUs now power everything from ChatGPT-style models to enterprise AI systems and autonomous technologies.

Analysts widely view Nvidia as the backbone of modern AI a position that has translated directly into massive shareholder rewards.

Elon Musk and the AI Ecosystem Effect

Elon Musk’s wealth surge is tied not just to one company, but to his growing footprint across AI-related ventures. From AI research and model development to autonomous systems and data-driven platforms, Musk’s businesses benefit from investor enthusiasm surrounding AI’s long-term potential.

As markets increasingly price companies based on their AI exposure, executives linked to the AI narrative continue to see outsized gains.

The Growing Wealth Gap Debate

While markets celebrate AI-fueled growth, the wealth surge has also reignited concerns about inequality. Critics argue that AI’s financial rewards are concentrating among a small group of tech leaders and investors, while job displacement and automation risks fall on workers.

This tension is fueling renewed calls for AI regulation, profit-sharing mechanisms, and policies that ensure productivity gains benefit society more broadly.

The Bigger Picture

The AI boom is proving to be more than a technological shift, it’s a historic wealth transfer driven by ownership of algorithms, data, and infrastructure. For tech billionaires, AI has become the fastest accelerator of personal wealth in modern history.

As AI adoption deepens across the global economy, the central question remains: will AI’s financial upside stay concentrated at the top, or can it be shared more evenly in the years ahead?

Leave a comment