SoftBank Group has agreed to a roughly $4 billion deal involving DigitalBridge, marking one of the most significant U.S. infrastructure plays tied directly to the explosive growth of artificial intelligence. The move underscores a simple but powerful reality: AI’s future depends on physical infrastructure as much as algorithms.

Why DigitalBridge Is Central to the AI Race

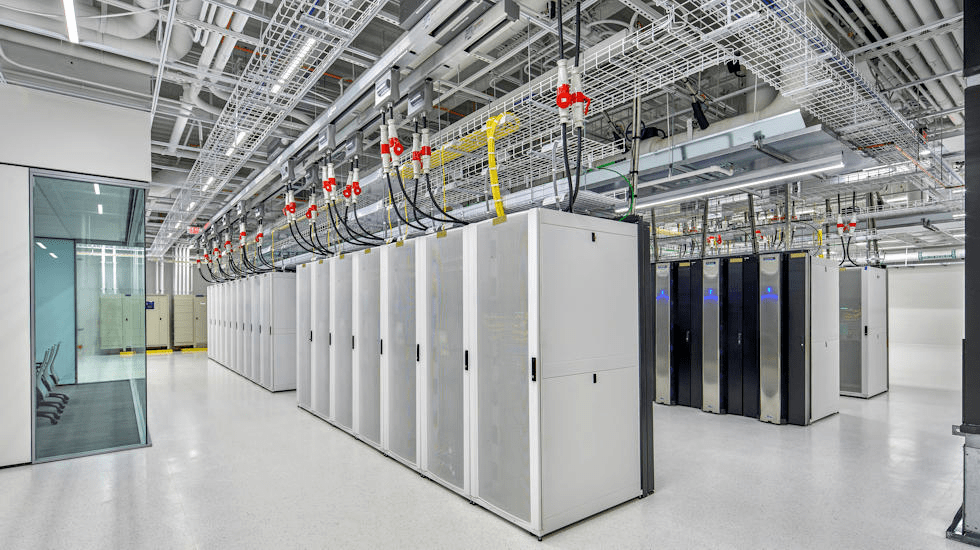

DigitalBridge specializes in owning and operating the backbone of the digital economy data centers, fiber networks, and edge infrastructure. As AI models grow larger and more compute-hungry, demand for low-latency networks and massive power-ready facilities has surged.

By backing DigitalBridge, SoftBank is positioning itself at the foundation layer of AI where cloud providers, hyperscalers, and AI labs all converge.

Fueling the AI Compute Explosion

This deal is closely tied to the unprecedented demand for AI compute driven by companies like OpenAI, cloud platforms, and enterprise AI deployments. Training and running next-generation models requires vast data centers, specialized chips, stable energy supplies, and ultra-fast connectivity.

SoftBank’s investment aims to accelerate:

- Large-scale AI data center construction across the U.S.

- Expansion of fiber networks to support real-time AI workloads

- Long-term capacity planning for future AI systems that don’t yet exist but are already being designed

Masayoshi Son’s Long-Term Vision Comes Into Focus

For years, SoftBank founder Masayoshi Son has spoken about an AI-driven future shaped by intelligent systems at every layer of society. This DigitalBridge deal shows a more grounded, infrastructure-first strategy less about flashy apps, more about owning the rails that power AI itself.

Instead of betting only on AI software startups, SoftBank is now anchoring its vision in assets that will remain essential regardless of which AI model wins.

The Bigger Industry Shift

This move reflects a broader trend across Big Tech and global investors:

- AI competition is shifting from models to compute access

- Infrastructure has become a strategic moat

- Data centers are now treated like energy grids or transportation networks critical national assets

As governments and corporations scramble to secure AI capacity, firms controlling digital infrastructure gain immense leverage.

What This Means Going Forward

SoftBank’s DigitalBridge deal signals that the AI boom is entering a new chapter one defined by steel, silicon, fiber, and power, not just code. The winners of the next decade may not only be the companies building smarter AI, but the ones ensuring there’s enough infrastructure to run it.

In the race for AI dominance, SoftBank is betting that owning the backbone matters just as much as owning the brain.

Leave a comment